Health Savings Account

Health Saving Account

Health Savings Account (HSA)

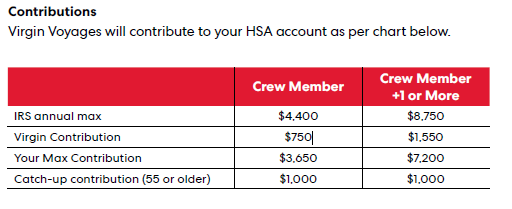

- Annual Max | $4,400 Single / $8,750 Family Per Year

- Employer Contribution | $750 Single / $1,550 Family Per Year. *

- You must be enrolled in the Cigna’s Choice Fund OAP HSA offered by Virgin Voyages

- Have no other non-HSA insurance policy coverage

- Have waived enrollment in the FSA plan prior to 1/1/2024

- Are not enrolled in Medicare

- Cannot be claimed as a dependent on someone else’s tax return

*Total contributions cannot exceed the annual maximum of $4,400 single and $8,750 family as set by the IRS.

Common Eligible Expenses

Acupuncture | Dental Treatment | Lab Work | Orthodontia | Birth Control | Prescription Eyeglasses | Medical Supplies | Radiology | Chiropractor | Fertility Enhancement | Physical Exams | Smoking Cessation programs | Contact Lenses | Hearing Aids | Prescriptions | Therapy

Your HSA lets you choose when and how you access your money:

Debit Card – Use the Cigna-branded VISA debit card to pay for out-of-pocket expenses.

Online Account Access – gives you the ability to transfer money directly to your personal account for reimbursement

Checkbook – You can order a checkbook and write checks to pay for out-of-pocket expenses.

Health Savings Account

What’s better than saving for things that keeps you healthy?

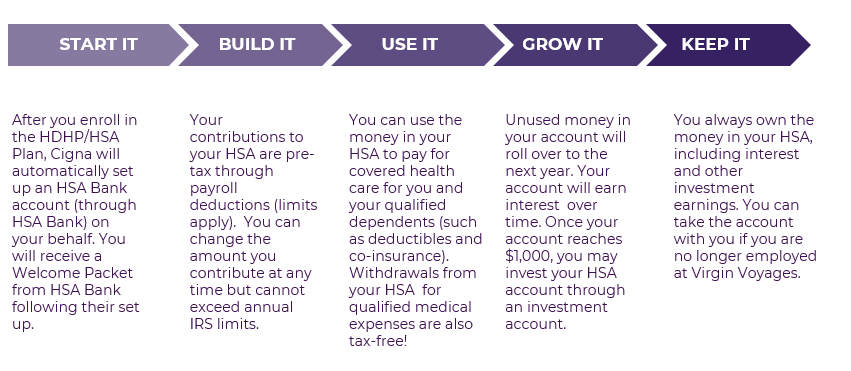

A Health Savings Account (HSA) is a tax advantaged personal savings account to pay for qualified healthcare related expenses now and into retirement. The HSA is available only to crew members who are enrolled in the CIGNA Choice Fund OAP HSA. HSA dollars can be used to pay for out-of-pocket medical, dental, vision and prescription expenses.

The funds you contribute to the account are not subject to federal income tax at the time of deposit. Unlike a flexible spending account (FSA), funds in an HSA roll over and accumulate year after year if not spent. Your HSA is owned by you and, as a result, is portable. In other words, ownership of your HSA balance is not affected by a change of jobs.

Who is eligible for an HSA?

Because HSAs offer a federal tax advantage, the IRS has rules about who is eligible to open or contribute to them. You are eligible for an HSA if you meet all of the following conditions:

- CIGNA Choice Fund OAP HSA Plan is the only medical plan in which you are enrolled

- You aren’t enrolled in Medicare, Medicaid, TRICARE, TRICARE for Life or a military benefit program

- You aren’t a dependent on another person’s tax return or covered as a dependent under your spouse’s plan (e.g. PPO, POS, or HMO)

How do I access my HSA money?

Once you have opened the HSA, you will automatically receive an HSA Bank debit card. Use this card at doctors’ offices, pharmacies and drug stores. You do not need to file claims to access your money, but you are encouraged to save your receipts in the event you are audited by the IRS.

How much can I contribute to my HSA?

The IRS maximum for 2025 is $4,400 for Crew member only and $8,750 for Crew Member + 1 or more. If you are age 55 or older, you may contribute an additional $1,000 annually in catch up contributions.

Advantages of a Health Savings Account

The BIGGEST advantages are: the money is yours, is held in a investment account, and is portable. Additional advantages of owning an HSA are:

Security – Your HSA can provide a savings buffer for unexpected or high medical bills.

Affordability – In most cases, you can lower your monthly health insurance premiums when you switch to health insurance coverage with a higher deductible, and these HDHPs can be paired with an HSA.

Watch your HSA grow – Your HSA account earns tax-free interest. Maximize your tax-free earning potential by investing HSA funds using the convenient online investment tool.

Flexibility – You can use your HSA to pay for current medical expenses, including your deductible and expenses that your insurance may not cover, or you can save your funds for future medical expenses, such as:

- Health insurance or medical expenses if unemployed

- Medical expenses after retirement (before Medicare)

- Out-of-pocket expenses when covered by Medicare

- Long-term care expenses and insurance

Savings – You can save the money in your HSA for future medical expenses, all while your account grows through tax-deferred investment earnings.

Control – You make the decisions regarding:

- How much money you will put in the account

- When to make contributions to the account

- Whether to save the account for future expenses or pay current medical expenses

- Which expenses to pay for from the account

- How to invest the money in the account

Portability – Accounts are completely portable, meaning you can keep your HSA even if you:

- Change jobs

- Change your medical coverage

- Become unemployed

- Move to another state

Ownership – Funds remain in the account from year to year, just like an IRA. There are no “use it or lose it” rules for HSAs, making it a great way to save money for future medical expenses.

Tax Savings – An HSA provides you with triple tax savings:

- Tax deductions when you contribute to your account

- Tax-free earnings through investment

- Tax-free withdrawals for qualified medical expenses

How a Health Savings Account Works

HSA Contributions